Avalara

The Avalara Plugin Feature will be used in the Store Seller. Avalara provides transparent transactions, accurate tax compliance, painless administration and effortless reporting. Avalara offers full service sales tax management tools utilizing progressive technology to automate the burden of statutory transactional tax compliance.

Avalara can help with complex tax calculation, filing returns, managing exemption certificates and allows businesses to calculate sales tax amounts on their invoices based on location. For instance, if you sell something in the city of Atlanta, do you know if you have a local sales tax or not? By classifying a sale in Avalara and inputting the proper address of where you sold your item, it automatically states the correct tax rate. It’s one less thing you have to keep up with for customers.

Use their table that plugs in with every single invoice, and it tells what tax to charge.

Avalara's flagship product, AvaTax has become the automated sales tax compliance solution for businesses all over the world. In fact, Avalara leads the market and integrates seamlessly into more financial and e-Commerce applications than any other product or service available.

Avalara Plugin Feature enables you to quickly and easily calculate sales tax amounts and much more. All you need to do is follow some simple steps below.

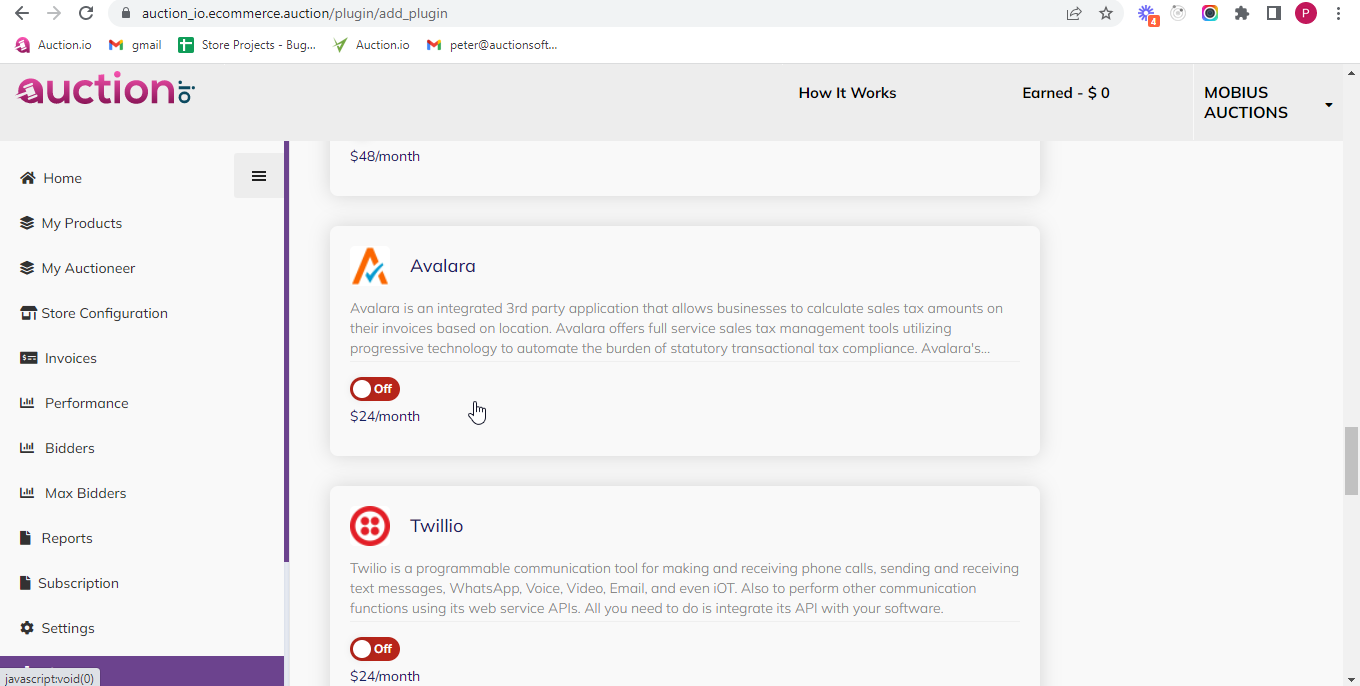

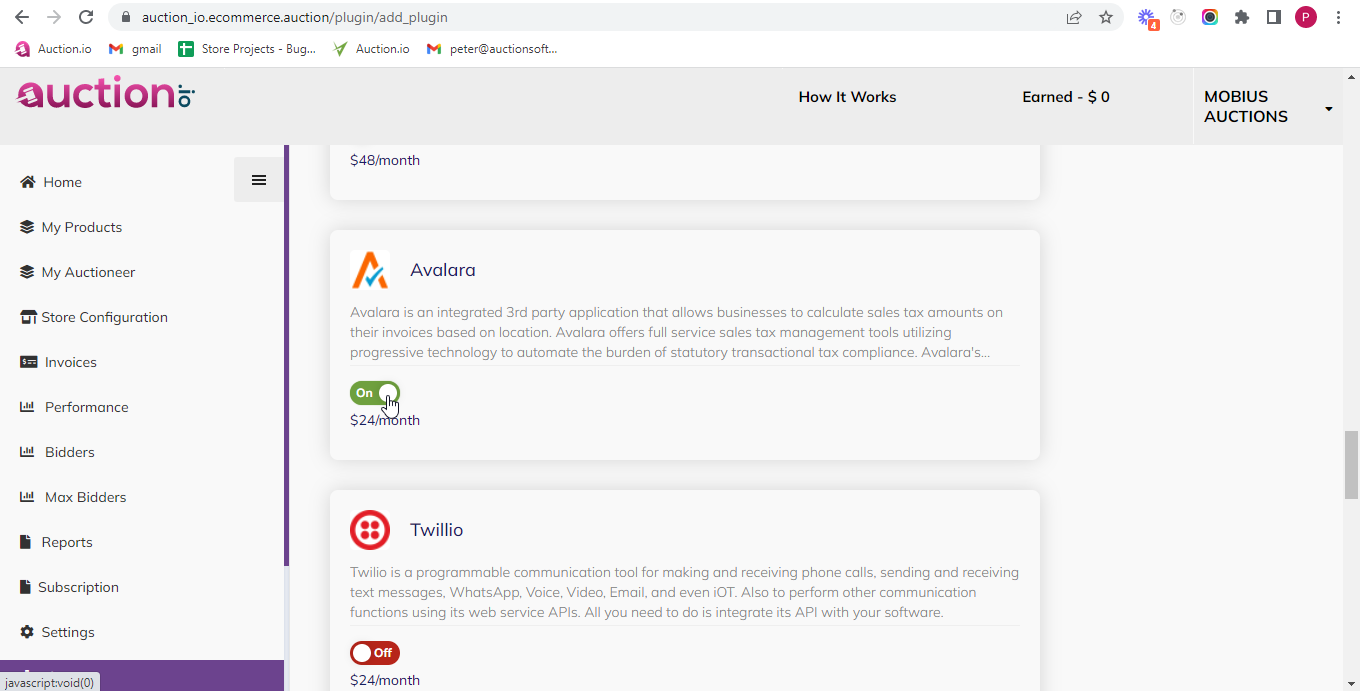

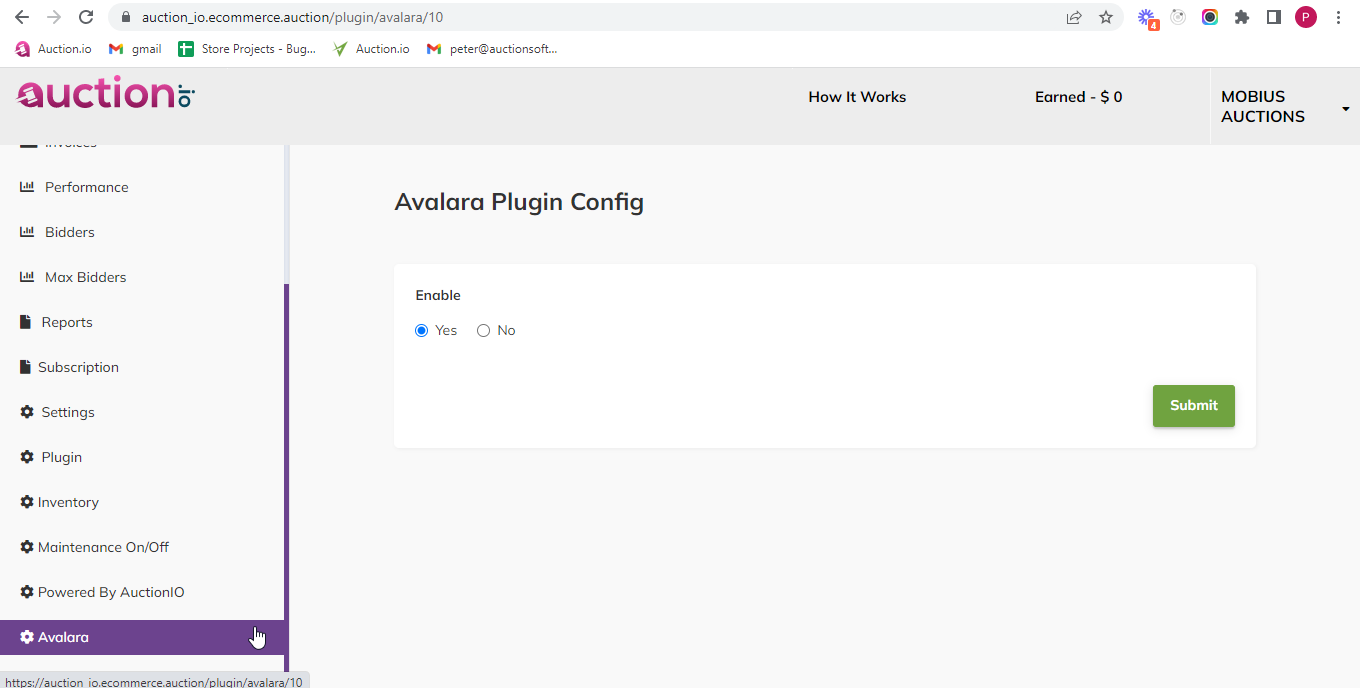

Active / Deactive the Avalara Plugin

You can On / Off the Avalara Plugin in your website using the Avalara plugin as Shown below.

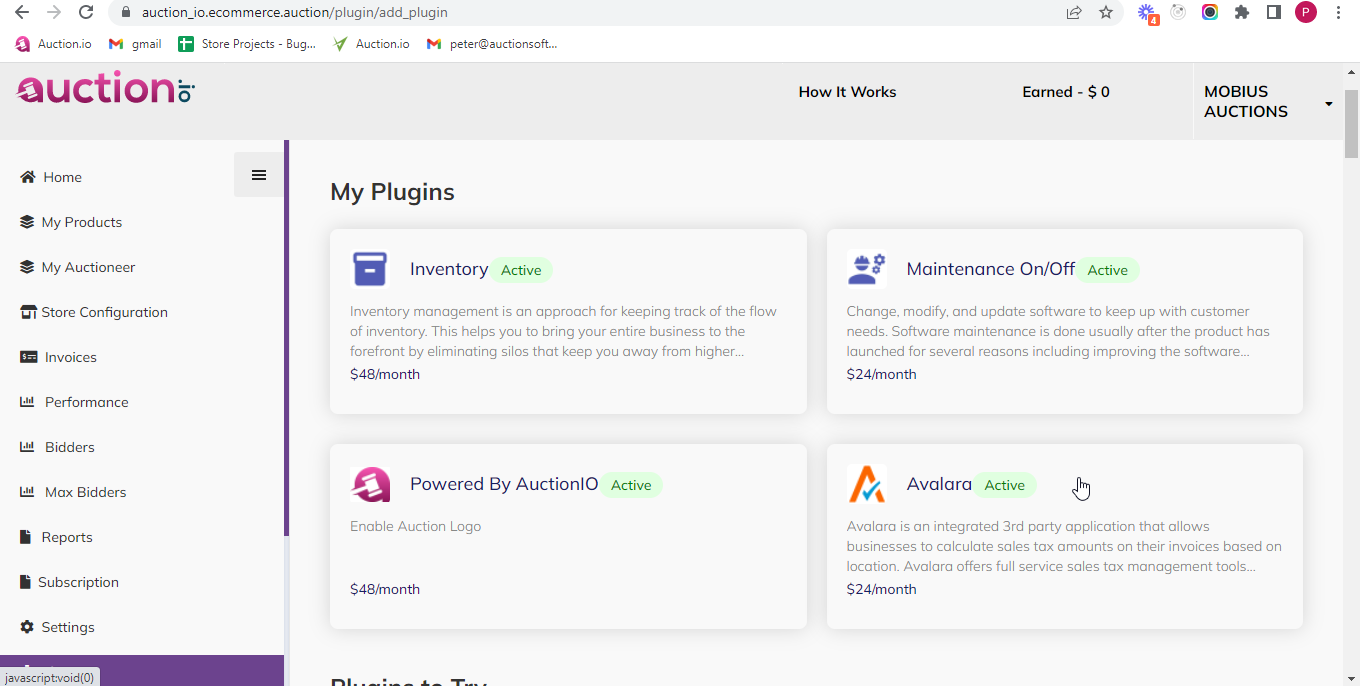

It will be Show in the active plugin section as shown below.

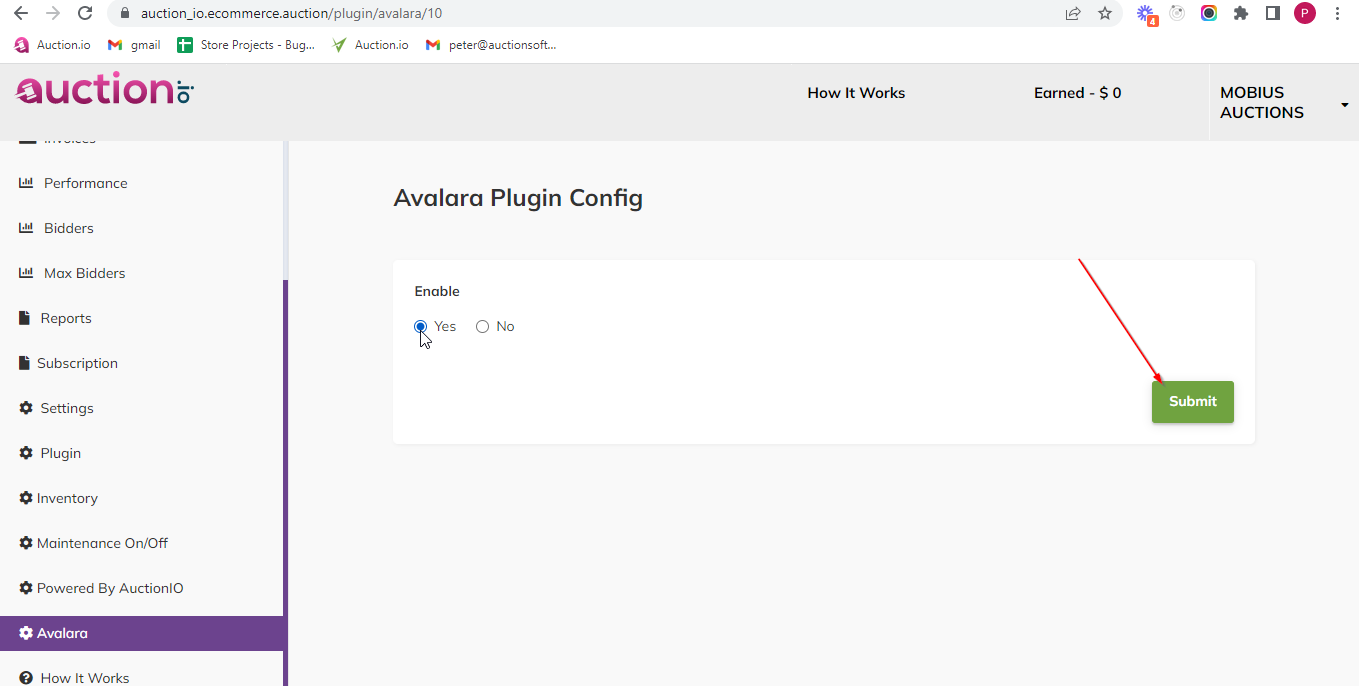

Enable the Avalara Plugin

Next Click Avalara In this if you click yes on enable then it will be enabled.

Once you are Completed with your changes, click on the ‘Submit’ button.